- WineFi

- Posts

- WineFi - where are we in the wine market cycle?

WineFi - where are we in the wine market cycle?

Plus - link to our latest webinar, and a syndicate sourcing update.

In this week’s newsletter:

Details of The Lay & Wheeler Collection 🤝

Where are we in the market cycle? 🔁

Syndicate Sourcing Update 📈

Investment Opportunity: The Lay & Wheeler Collection

The Lay & Wheeler Collection closes on Wednesday 20th August. As a reminder - this partnership utilises Lay & Wheeler’s deep supply-side access alongside WineFi’s quantitative expertise to present an opportunity positioned to outperform the wine markets.

Last week, we hosted a Webinar alongside the L&W team to talk through the opportunity and answer questions from participants. If you would like to view the recording - please find the link below.

The Wine Market Cycle

Since the October 2022 peak, the fine wine market has experienced its largest and longest drawdown on record. The downturn has now extended beyond previous historical cycles, with values retracing significantly from their highs.

While this extended bear phase has been challenging, recent data presents a more complex picture, with some indicators suggesting that conditions could be improving – though others caution against premature optimism.

Recovery Indicators

Price Stability Returning

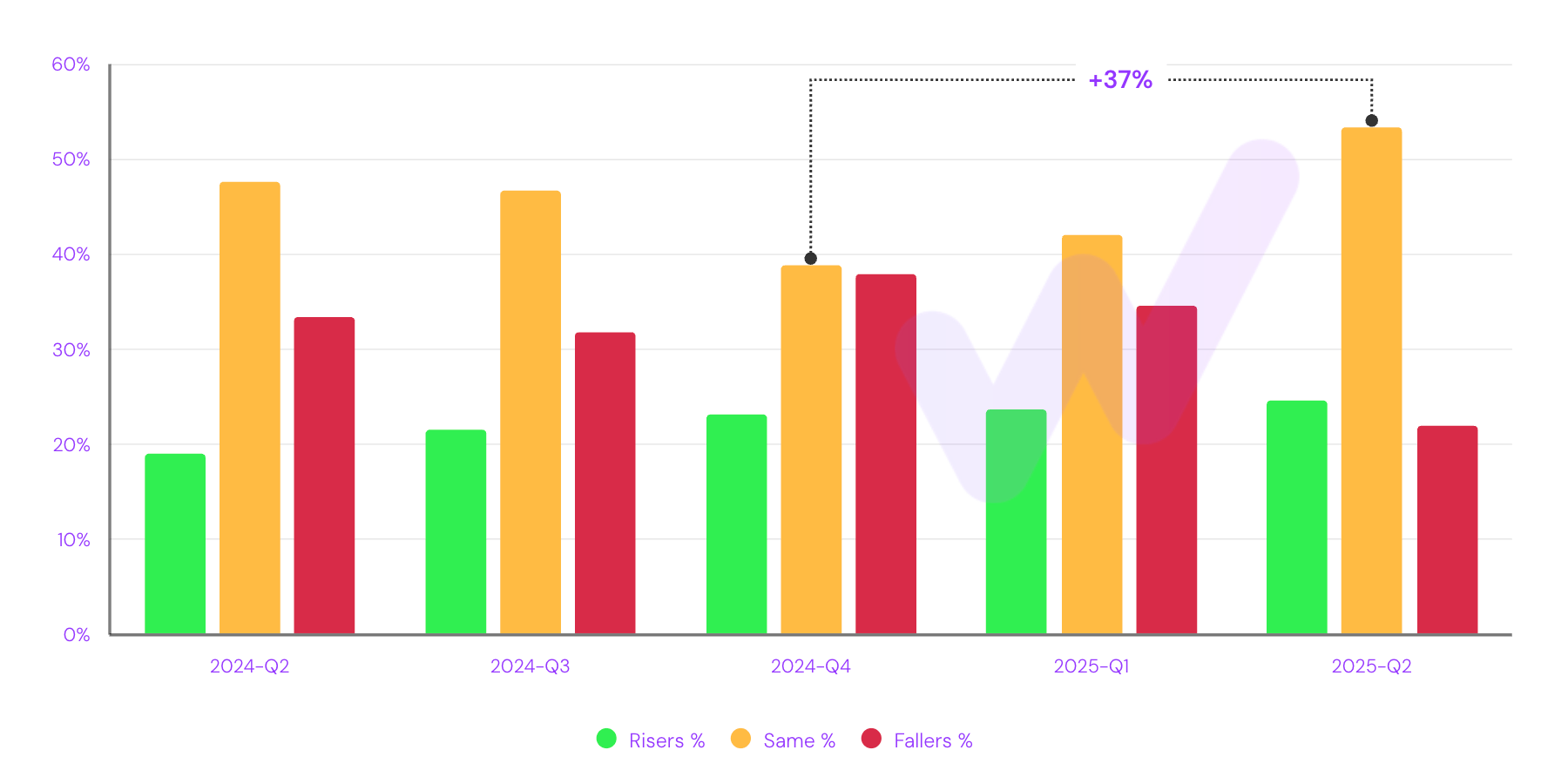

The proportion of assets with unchanged pricing has risen steadily from 38.89% in Q4 2024 to 53.40% in Q2 2025 – a 37% relative increase. This shift suggests reduced volatility and a reversion to more typical trading conditions, as merchants appear less inclined to cut offers.

Falling Asset Share Declines

The proportion of wines registering price declines has dropped to 21.94% – the lowest level in nearly two years – indicating that downward pressure on valuations is easing.

Price changes for ~66,000 investment grade wines based on Liv-ex market price and other best list price data at 30/06/2025.

Volatility Compression

Cross-sectional volatility, a key measure of market dispersion, has fallen to its lowest reading in over two years. This reduced spread between winners and losers can indicate broader market consolidation, a typical precursor to recovery phases.

Based on Liv-ex market prices and other best list price data for ~60,000 investment-grade wines as at 30/06/2025.

Resilience at the Premium End

The record-breaking Q2 2025 Christies auction in New York underlined enduring demand for scarce, high-quality wines. More than half of lots sold achieved prices above their nine-month averages, with an average uplift of 20% and standout lots far exceeding estimates. Such strength at the top end can often filter down into broader market confidence over time.

Renewed Asian Demand

The Liv-ex has reported that Asian purchase value in May was up 10.1% on April, up 25.2% on the May 2024 level, and 33.7% above the 2024 average. The Asian markets were a large factor in the prolonged period of growth in wine market prices, and it’s encouraging to see the region re-entering the markets.

Cautionary Signals

Muted Trading Activity

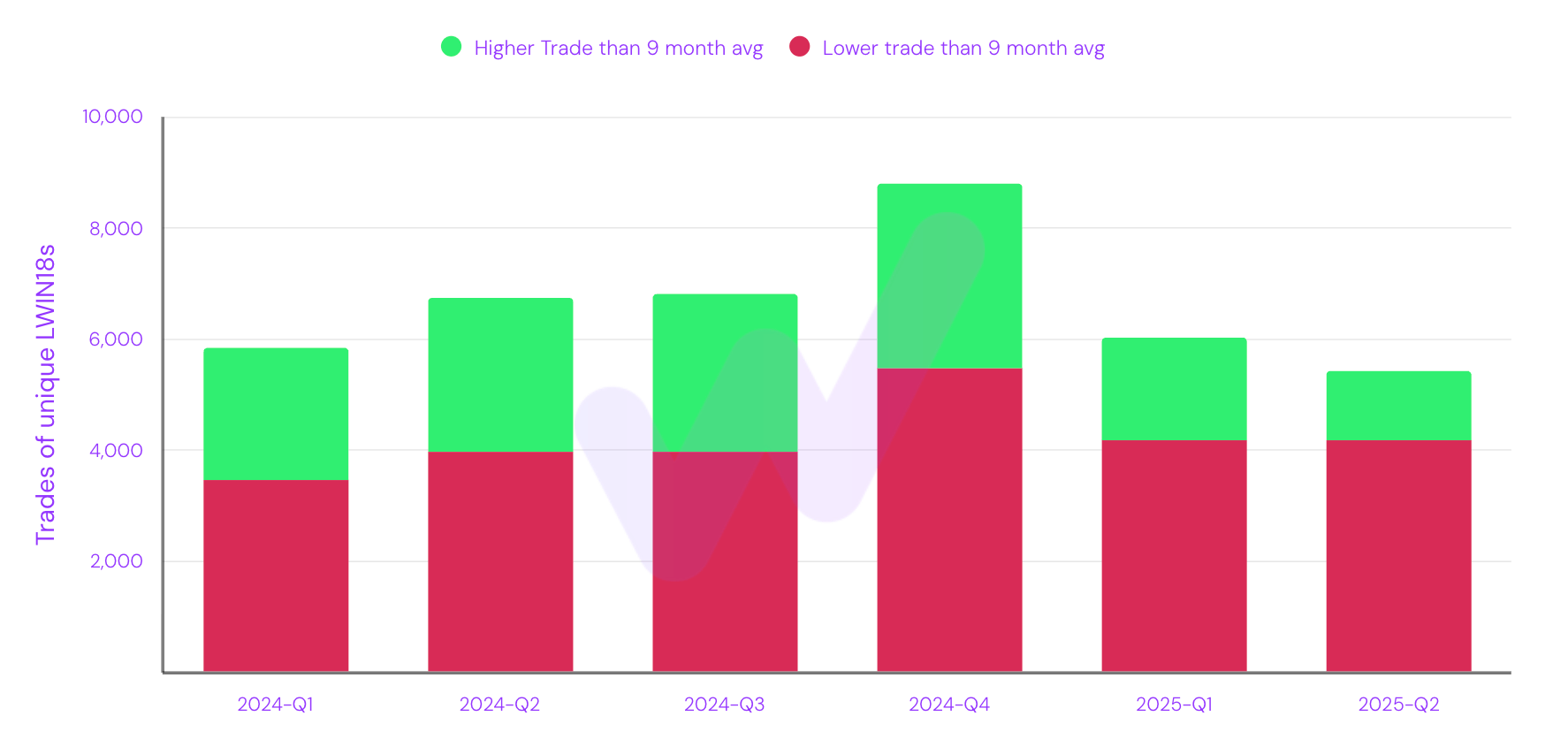

While price stability has improved, transaction volumes in Q2 2025 have decreased. A larger proportion of trades are now occurring below their nine-month averages, indicating that buyers remain selective and risk-conscious.

Based on transactions for wines that traded in public auctions and online exchanges, only SKUs with at least two trades in the prior three quarters are included, and comparisons are limited to exact pack and bottle size matches.

Potential False Signals from Low Volatility

Reduced volatility is not always a sign of health – it can also occur when fewer wines trade at all, with many remaining static in price. This could reflect caution rather than renewed confidence.

Long-Term Trend Still Negative

The WineFi Fine Wine Index remains well below its 2022 highs, and while recent months have shown less downward momentum, the broader price trajectory remains in decline.

Context for Investors

History suggests that extended bear markets in fine wine have often ended with a period of stabilisation before a gradual recovery. The current data mirrors this pattern in part – especially in terms of reduced volatility and declining numbers of falling assets – but the absence of robust trading activity tempers the strength of the signal.

While no single indicator confirms the turning point, the divergence between premium auction results and more subdued secondary market activity may be telling. WineFi’s own syndicate performance, which has consistently outperformed market indices during this downturn, highlights the value of targeted, quality-focused selection in navigating such cycles.

For now, investors may view the market as being in the early stages of potential recovery, with selective opportunities emerging – but with enough uncertainty to warrant patience and disciplined positioning.

Syndicate Sourcing Update

Syndicate members can view their existing portfolio composition by clicking on their live sourcing update links from their onboarding email. Once the portfolios are fully sourced they will be bulk uploaded to the platform so performance can be tracked in real time.

Please reach out to us if you have any questions.

The Icon Collection: 48%

Burgundy II: 30%

Invite a Friend, Share the Rewards

Fine wine is best enjoyed with friends — and at WineFi, we believe investing in it should be too. Our referral scheme rewards you for introducing friends and family to WineFi.

As a referrer, you’ll receive a credit towards your next WineFi investment or a Lay & Wheeler gift card of equal value. Your referees will also receive a matching credit. There’s no limit to the number of people you can refer.