- WineFi

- Posts

- WineFi Weekly: Diversification

WineFi Weekly: Diversification

The role that fine wine should play in a diversified portfolio, and the importance of diversification within your wine investment.

The role that wine should play in a diversified portfolio

Diversification at the Portfolio Level

The strategy of spreading investments within a portfolio to manage risk and potentially enhance returns.

At the portfolio level, wine offers equity-like returns with low volatility.

Fine wine also provides an effective means of diversification within an investment portfolio. It is uncorrelated with traditional asset classes, providing protection against swings in the traditional markets.

Liquidity Considerations

Despite these benefits, it's crucial to remember that fine wine is less liquid than stocks or bonds, and this is why it should only form a small part of a portfolio.

It is important when investing in wine to select assets with strong secondary market demand.

Fine wine should be considered a long term hold, and be combined with other more liquid assets as part of a diversified portfolio.

Diversification at the Wine Level

Our analysis shows that the optimal amount for full diversification in the wine markets is upwards of £300,000. Evidently quite a high entry point for the typical investor.

The ideal portfolio diversifies across region, sub-region, vintage, price bracket, bottle format.

Regional Diversification

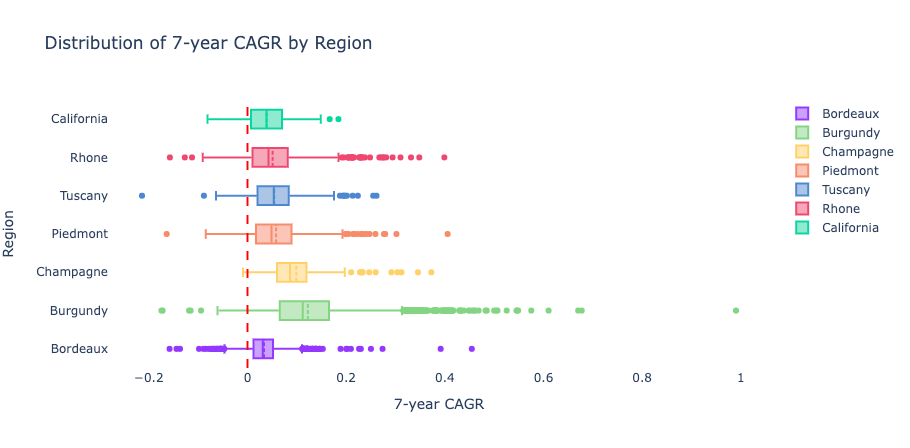

Regions represent different risk profiles. Tuscany has grown consistently over the last 20 years and has been the region most resistant to the recent market downturn but is less likely to shoot the lights out in terms of returns. This is evidenced by the narrower distribution of returns below:

Price Bracket Diversification

Different price ranges represent differing risk profiles. Over the last 7 years, wines below £9,600 (12x75cl case price) had a higher proportion of wines averaging CAGR over 25% than those at a higher price.

More consistently high and predictable returns however, are to be found at higher price ranges £9,600 - 19,200, with names like DRC. These wines are very unlikely to 10x in price but have demonstrated consistently strong returns across all vintages for some time now.

Vintage Diversification

Smaller, less diversified portfolios have increased exposure to:

Changing critic scores of a given vintage;

Vintages aging in an unexpected manner;

Risk of producers releasing “held back” stock for a given vintage.

Format Diversification

A small portfolio size often leads to investment in small case sizes which tend to be more common, and have less chance of selling for a rarity premium upon exit. We find that this is particularly true of older and more expensive wines.

How does WineFi bridge that gap?

By investing via a syndicate, investors gain access to much greater diversification at a fraction of the cost of owning the assets outright.

All of our past syndicates have an investment remit of over six figures, allowing asset selection in line with the findings above.

What’s happening at WineFi?

Wealth Briefing Article

It’s excellent to see our CEO Callum featured last week in a Wealth Briefing article - A Spotlight on Wine Investment.

Callum discusses the characteristics of the wine markets, WineFi’s unique approach to investing, and the place that fine wine should have in an investor’s portfolio.

Sponsorship Announcement:

The Wentworth Resident’s Association Invitational Day

We’re pleased to announce our sponsorship of the WRA’s annual golf day, alongside Knight Frank, NFU Mutual and others.

Wentworth Residents will be competing for bottles of Chateau Palmer provided by WineFi amongst a variety of other prizes.

Fine wine is an alternative and illiquid asset class and should only form a small part of a well-diversified portfolio. The value of your investment can go down as well as up and you may not get back the full amount you invested.