- WineFi

- Posts

- 🍷 WineFi Weekly - 29/07/2024🍷

🍷 WineFi Weekly - 29/07/2024🍷

WineFi Weekly #19

New partnerships, a Burgundy deep-dive, and how you can invest in Burgundy from just £3,000

📅 July 29th 2024

Interested in receiving details for The Burgundy Collection? Click here to sign up.

The Burgundy Collection Recap

We have seen great demand for The Burgundy Collection so far, and this week’s newsletter will provide some more insight into the selection process!

What is The Burgundy Collection?

Our co-investment opportunities allow investors to access a diversified basket of the rarest investment grade wine from £3,000 - a fraction of the cost of owning the underlying assets outright.

The Burgundy Collection will be investing in ultra rare wines from arguably the most prestigious region in the world.

An Introduction to Burgundy

Burgundy is one of the world's most renowned wine regions, celebrated for its exceptional Pinot Noir and Chardonnay wines. The region is characterized by a complex terroir, with a patchwork of small vineyards, each with its unique soil, microclimate, and topography, contributing to the distinct qualities of its wines.

Burgundy's meticulous viticulture and winemaking traditions emphasize the expression of terroir, resulting in wines that are highly sought after for their elegance, complexity, and aging potential. The region also boasts a rich history, with winemaking traditions dating back to the Roman era and further refined by Cistercian monks during the Middle Ages.

Why Burgundy?

Reputation

Burgundy is home to some of the most sought after wine in the world.

9 of the top 10 most expensive wines in the world (by average case price) are from Burgundy, highlighting the extreme prices that buyers are willing to pay to secure these top wines.Scarcity

The elite producers in Burgundy produce at levels far below their Bordeaux, or Champenois counterparts. This limited production exacerbates the market dynamics present across wine investment markets.Performance

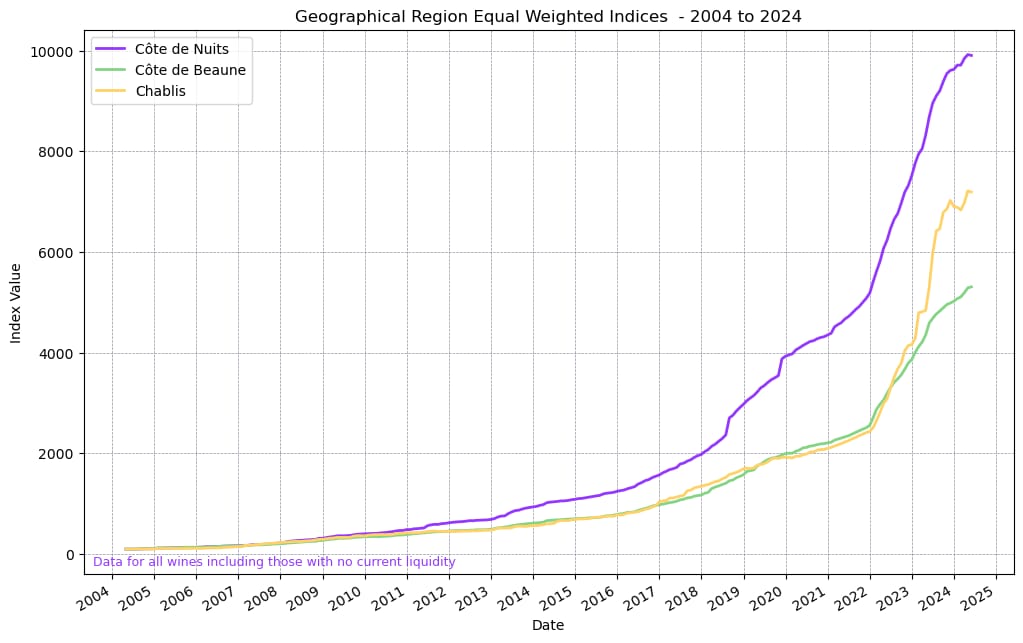

Our analysis of Burgundy shows strong returns. The average annual returns for vintages between 2013 and 2022 over the last 10 years is 18.6%.

Market Timing

In terms of timing the market a strong argument can be made that - after a period of madness during and post covid - prices appear to be returning to a long term trends.

The Process

The WineFi Investment Score (WIS)

A major leap forwards for us has been the systematisation of our asset selection process via the establishment of the 'WineFi Investment Score' (WIS).

This is a significant new development that ranks wines in terms of their 'investability' -- accounting for historic returns, consistency of returns across vintages, liquidity and the reliability of the data.

Labels with sparse pricing data (indicating poor secondary market liquidity) are disregarded. We believe this method reliably uncovers wines for which demand most consistently outstrips supply. All prices referenced are Liv-ex market prices for a 12x75cl case (GBP).

Visualisation

Price ratios, visualised well by heat maps such as the below, are used to compare 1000s of vintage prices within a label. Identifying overvalued and under-valued vintages on the market, and pick specific vintages to target. Where appropriate these ratios are adjusted to additionally account for critic scores.

The Expert (Peter Lunzer)

The recommended portfolios are then analysed by Peter Lunzer, a member of WineFi’s Investment Committee with 30+ years experience in the wine trade, and more than £85m invested on behalf of clients.

This qualitative layer is crucial for the process. The wine trade has so many secrets/rules of thumb known only to those with years of experience, and in our mission is to transfer this knowledge to our investors, Peter’s experience is key.

Data: Liv-ex

New Partnerships!

WineFi x Haatch

We are very excited to offer Haatch’s investor base access to fine wine as an asset class, via our syndicate. Haatch are a leading S/EIS fund who accelerate Pre-Seed B2B SaaS companies to their first £1m ARR and build the infrastructure to get to £10m+.

So, why are we doing this?

• Haatch's investors are seasoned alternative asset investors. Working together, WineFi and Haatch can offer these investors seamless access to an emerging asset class (fine wine) at a fraction of the cost of existing channels.

• Fine wine is highly tax-efficient, but it isn't SEIS or EIS. Many investors don't know that fine wine is, in many circumstances exempt from Capital Gains Tax (CGT).

• Risk-adjusted returns from fine wine have historically been compelling. Burgundy has outperformed all other wine regions in recent years. Our analysis of the 2094 most liquid wines from Burgundy reveal a 21% CAGR over the past 10 years -- achieving a 580% total return over the same period.

WineFi x Founders Capital

We are also extremely excited to announce that we will be working with Founders Capital (FC) to offer a FC exclusive allocation to The Burgundy Collection.

Founders Capital is a founder & operator-driven investment community, connecting members and investors with the most the most sought after private companies on the planet across various stages.