- WineFi

- Posts

- WineFi: The Signal Collection Closing in 12 Days⏳

WineFi: The Signal Collection Closing in 12 Days⏳

Investors have until 19th December to secure their spot.

Welcome to the WineFi Newsletter

This week, a spotlight on The Signal Collection.

What is The Signal Collection?

Why is now a good time to invest?

When is the deadline?

What is The Signal Collection?

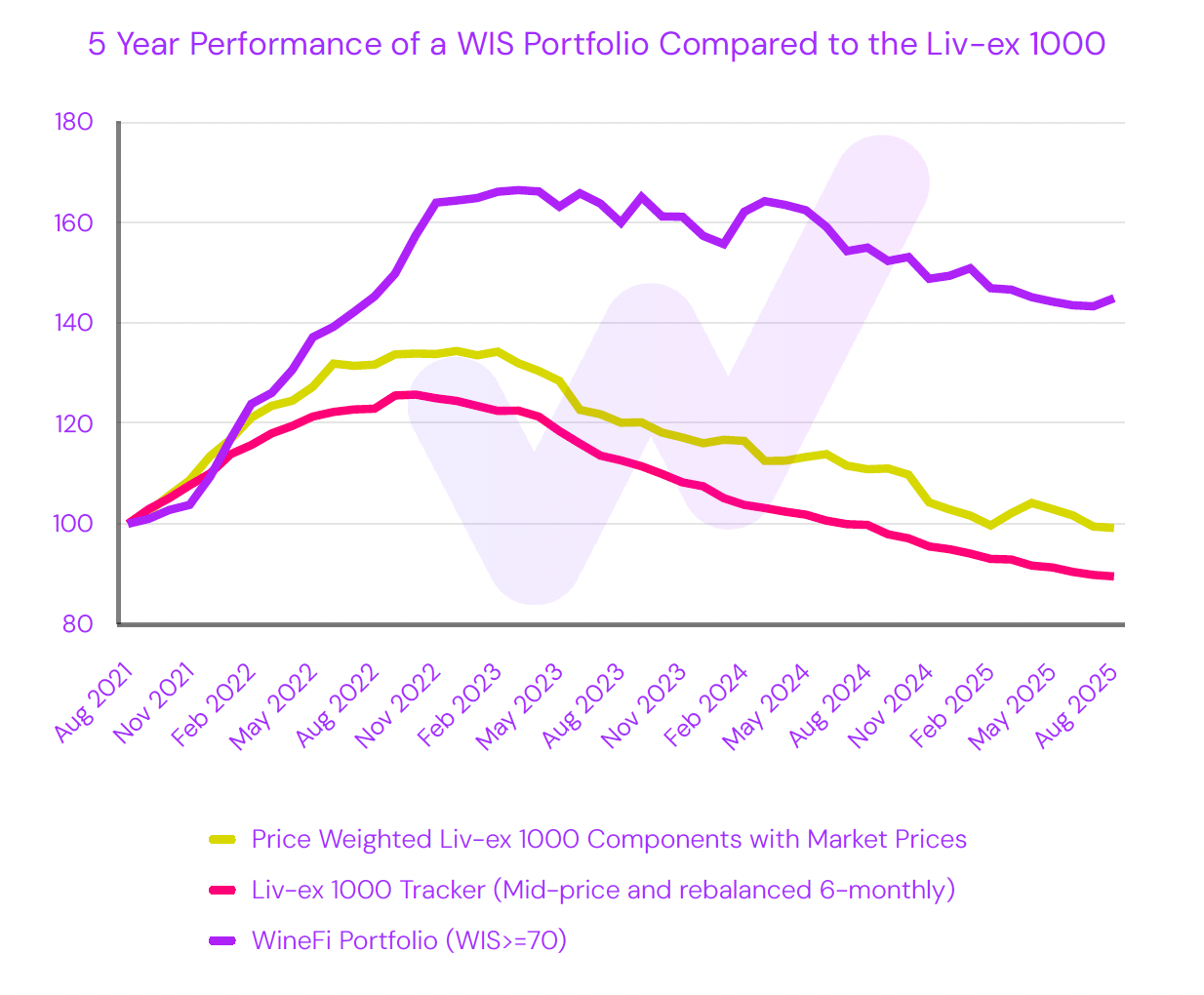

The Signal Collection is WineFi’s data-driven fine wine syndicate, giving investors access to a curated portfolio of the world’s most prestigious wines. Using machine-learning models built on 18 million datapoints and over 60,000 wines, we identify assets with the highest likelihood of appreciation.

Only wines with strong fundamentals - vintage quality, brand strength, lifecycle position and favourable pricing - are selected, and backtesting shows that every qualifying portfolio since 2009 has outperformed the Liv-ex 1000 with strong risk-adjusted returns.

In essence:

The world's most prestigious wines

Hardcore quantitative analysis

Expert Investment Committee oversight

The Signal Collection - Key Information

Minimum Investment: £3,000

Historic Performance (net of fees): 12.6% annualised return demonstrated across thousands of backtests on 5-year hold periods since 2009.

Tax Treatment: In many circumstances, fine wine is exempt from UK Capital Gains Tax. A letter of recommendation will be provided by a third-party UK tax specialist

Target Regions: Burgundy, Bordeaux, Champagne, Piedmont, Tuscany, Rhône, Rest of World.

Fees: A one-time administration fee of 12.5% (covering storage, insurance, and brokerage for the anticipated 5-year period).

Structure: UK bare trust nominee, enabling CGT exemption to pass through to syndicate members.

Anticipated Holding Period: 5 Years

Portfolio Construction: Only wines with a WineFi Investment Score (WIS) ≥72 are included. Permitted Investment is globally diversified, informed by quantitative analysis and verified by the WineFi Investment Committee.

Governance: Syndicates operate under a self-governance model. Members have full day-to-day control and vote on all decisions regarding acquisitions, disposals, and management of the portfolio.

Exit Strategy: Assets are sold progressively over the anticipated holding period, with proceeds distributed pro rata to syndicate members.

Why Now?

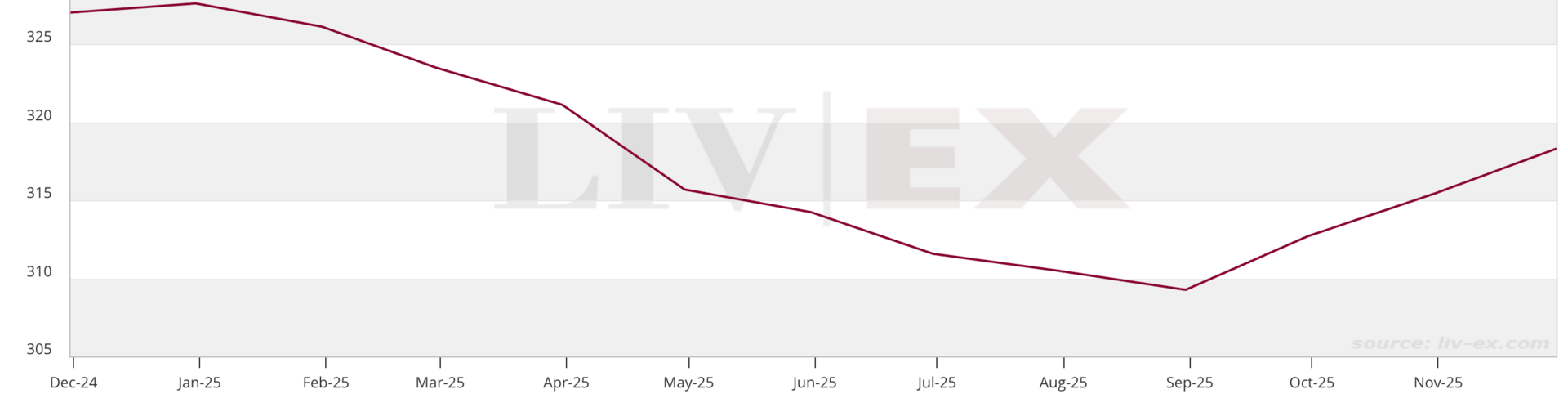

The fine wine market is entering a stabilisation phase after a prolonged downturn, with key indices showing recent positive momentum. Bid:offer ratios are also increasing - a backdrop historically associated with early-stage recoveries.

At the same time, fine wine continues to exhibit low correlation to traditional assets, offering diversification at a moment when investors are seeking resilience. With mis-pricings more visible after two years of dislocation, model-driven selection is particularly well-positioned to capture opportunities emerging in the current environment.

Chart Source: The Liv-ex

Deadline on the 19th December

The extended access period for The Signal Collection will close at midnight on the 19th of December.

This will be the final opportunity we run in 2025. If you would like a call to discuss the opportunity, and help shape your wine investing plan into 2026 - please book a call with our Head of Investment Matthew Small here.

Syndicate Sourcing Update

Syndicate members can view their existing wines by logging on to the WineFi platform.

Please reach out to us if you have any questions.

The Lay & Wheeler Collection: 67%