- WineFi

- Posts

- [Closing 8th March] Invest in The DRC Collection ⏳

[Closing 8th March] Invest in The DRC Collection ⏳

Access the most actively traded investment-grade wine producer in the world.

Welcome to the WineFi Newsletter

This week: We unpack the data behind the DRC Collection ahead of the 8th March deadline and review the opportunity in the broader market.

The Technical Case: Why the indicators signal a "buy."

Methodology: Validating the collection without bias.

Market Intelligence: The Drinks Business covers the recovery.

The DRC Collection - A Rare Entry Point

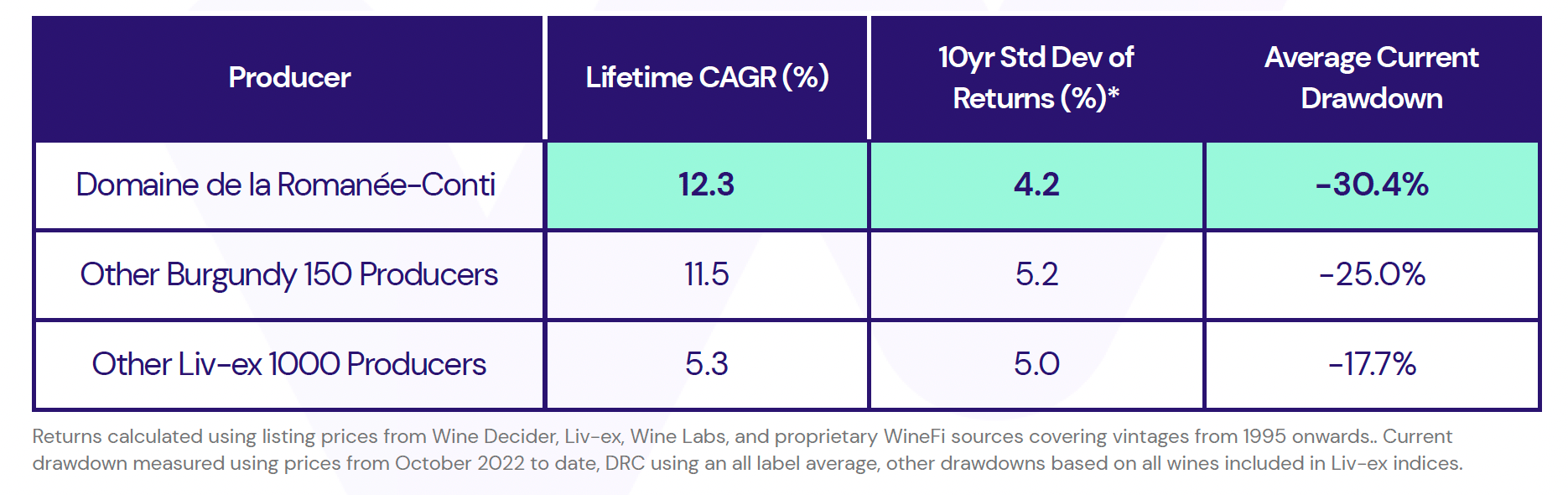

Sophisticated allocation is rarely just about asset selection; it is about exploiting market inefficiencies. Our analysis of the Liv-ex 1000 indicates we are emerging from a 34-month correction, a technical setup that historically precedes extended recovery phases.

While the broader market stabilises, DRC - a high-beta asset in this context - is currently sitting at a ~30% average drawdown from peak. This creates a compelling asymmetry: an entry point priced at a significant discount to recent highs, with the structural liquidity to lead the market recovery.

We are already observing bid-offer ratios improving, a leading indicator of returning liquidity. For investors seeking uncorrelated alpha, this is a tactical window to acquire the asset class’s "blue chip" leader at a cyclically advantageous valuation.

The DRC Collection - Validation through Data.

It is easy to look back at a chart of DRC and say, "that was a good investment." It is much harder to prove you would have made that decision in real-time.

To build the DRC Collection, we didn't just rely on historical returns. We utilised Walk-Forward Validation. As shown in the graphic below, we ran ~36,000 simulations where our algorithm "walked" through history year-by-year, utilising only the data available at that specific moment to make buying decisions.

This eliminates "data leakage." The model couldn't "cheat" by knowing which vintages would eventually become legends. It had to identify them using raw metrics available at the time. This methodology delivered a consistent strategy that delivered an 11.7% historic CAGR net of fees.

Drinks Business highlights “Flight to Quality”

Our data-led findings are now being mirrored by wider industry analysis. The latest article from The Drinks Business shows that blue-chip assets are defying the downturn and leading the next cycle.

The Data: New data from WineBusiness Analytics and Sovos ShipCompliant reveals a stark divergence: while shipments of wines under $60 fell by 17%, fine wines priced over $200 actually grew by 14% in value.

The Trend: The Drinks Business highlights that this trend is even sharper at the top, with ultra-luxury bottles ($10,000+) seeing a massive 28% year-on-year increase, confirming that smart capital is aggressively targeting "blue chip" scarcity.

"The high end of the market often leads the rest of the market out of downturns."